The REAL Market Report: November 2025

- Cam Vandersluis

- Dec 4, 2025

- 3 min read

LSTAR released their monthly report on the housing market yesterday and I wanted to jump on my market report faster than I did last month when I sent it out two weeks later than I meant to.

Please feast your eyes on these hot off the press stats, of which there are a couple of surprises!

Right off the bat, the headline statistic for November 2025 is the average sale price which continues to decline, no sitting at a touch over $584,000. That number is down 5.1% from last year and we have to go all the way back to 2020 to

see any positive gains in pricing. That is bleak, but it is also worth mentioning that the average sale price is up 55.4% since 2018 which is almost 8% annualized.

I would take 8% gains in any market for the rest of my life if it was guaranteed, hands down.

A stat that I don’t think I have ever mentioned before is the MLS HPI (Home Price Index) Benchmark Price which has been declining since the start of the year and is shown below.

I have heard this market described as a slow grind to a more balanced market and the slowly declining HPI price would certainly back that up. My only question is how far is this decline going to go or how long is it going to take to get to the bottom.

There is always a distinct possibility that the average and benchmark prices reverse and increase in 2026, something that we have seen happen each of the last three years.

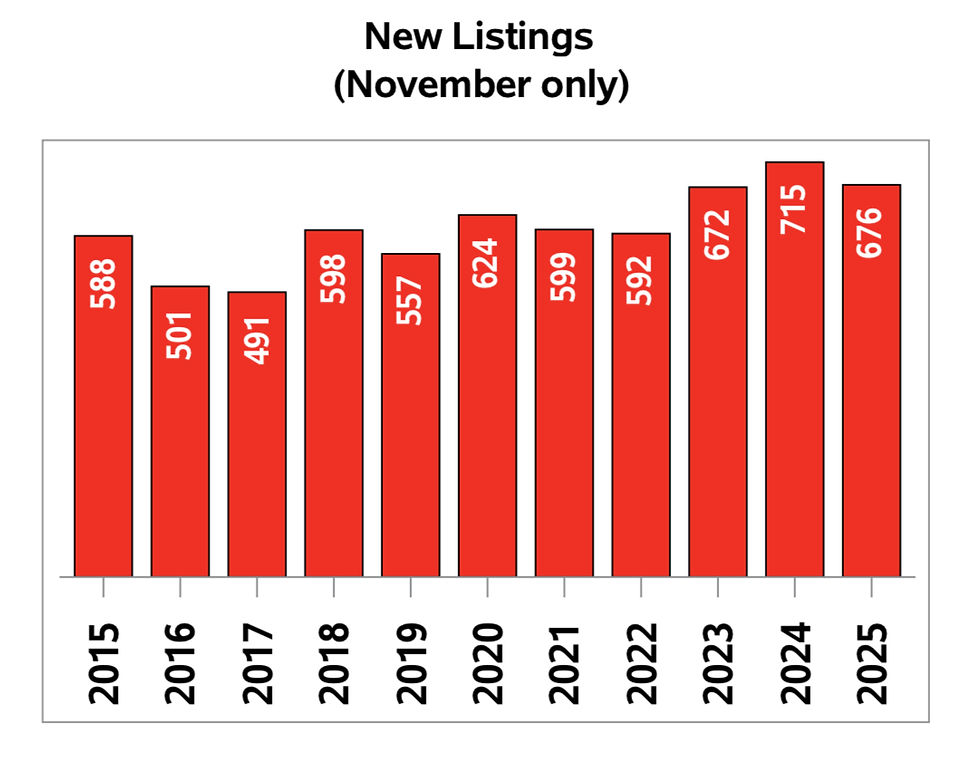

Not to be outdone, our next most interesting stat is that of new listings which came in surprisingly low! 676 new listings is 5.5% lower than last year and “only” 13% higher than the 10 year average.

Keep in mind that the number of new listings in September and October were more than a third higher than the 10 year average for those months.

The lower than expected new listings led to a decline in active inventory now sitting at 1838 homes available. That number is 25% higher than last year which cannot be ignored. Unless an unfathomable number of homes come off the market in December, we are going to start 2026 with more inventory on the market than I have ever seen.

In my opinion, this will make it difficult for the spring market to rebound and any gains in number of sales and pricing hard to come by.

However, if a decline in new listings continues and a new trend is established, that could start to tighten the market, but I’m not sure I see that happening.

On to sales, which at 323 in November, was less than I expected, and was 25% less than last year. It’s not as bad as the spring months this year, or September 2025, but it’s not encouraging if you are a seller.

It’s really hard to get a read on the market when the number of sales happening is so unpredictable.

You can see in the graph above how “number of sales” has performed compared to the 10 year average. The light line goes so up and down compared to the previous 2 years that there is no consistency to be had.

Here is what has become clear to me about our market in a few short points:

-rates are not holding buyers back and any discussion about interest rates either fuelling or hindering the market is misguided and useless information.

-so many people can’t buy before they sell and that is why there are so many homes available. These homeowners want to move.

-I see at least one sale price a day that reinforces that this is the best market to buy a house in that I have ever seen.

-I see it happening slowly but surely: sellers are becoming impatient and their list prices are beginning to reflect that.

I have to say that buyers have the best market available to them right now. Forget the fact that you have to be a seller first. Get that part over with and move on because being a buyer in this market is glorious.

For all of the people that hated the market we experienced 2019-2022, if you had anything negative to say about multiple offers, home selling well over the list price, “blind bidding”, this is your time to shine.

I’m sorry, but if you didn’t like that market, the market you asked for is hear and you cannot complain about it. You can’t have both, it’s one or the other. Both buyers and sellers can’t have it their way, it will never happen.

Comments